Where is Obama's “Summer of Economic Recovery?” And A Bill Without a Name

by Joshua Sanders on August 9, 2010 - 12:15pm

On June 17, President Obama and his administration announced this would be a summer of [economic] recovery. Obama’s plan, which consists primarily of public works projects, will not help the economy in the long run, and the achievements in the short run will be negligible.

In fact, it is clear that the government’s economic recovery act is not working. The record-breaking profits recently witnessed by corporations are largely the result of foreign sales. A jobless recovery is what officials claim we are experiencing. A jobless recovery is paradoxical. It cannot exist. The majority of America continues to feel the pinch of the recession, a recession that for many has existed far longer than economic indicators show.

“[L]ook at the jump in U.S. export growth, typically about 7 to 8 percent a year, but now in the double digits. The majority of manufacturing industries in this country, from electronics to furniture to consumer goods, are growing strongly because of demand in places like China, Brazil, and India,” Rana Foroohar of Newsweekwrites. “It’s no wonder customers in these emerging-market giants are feeling flush—their nations have come through a global recession without so much as a hiccup, and their job prospects are good and getting better. According to Goldman Sachs, every year for the next several years, at least 70 million of these emerging-market consumers will be joining the global middle class.”

For middle-class Americans, any government recovery effort would be temporary and costly. First, the government would have to take funds out of the private sector, which has a direct and opportunity cost. Funds taken from the private sector can no longer be used for investment or consumption (hence the opportunity cost). Governments are less efficient at expanding an economy than the private sector.

Just look at the efforts put forth by Obama’s recovery act, according to David Axelrod, a senior adviser to the president, who said: “This summer will be the most active Recovery Act season yet, with thousands of highly-visible road, bridge, water and other infrastructure projects breaking ground across the country, giving the American people a first-hand look at the Recovery Act in their own backyards and making it crystal clear what the cost would have been of doing nothing.”

The majority of the government’s spending will in no way boost real economic growth. The efforts of improving roads and water are admirable, but in our current state these are a luxury we cannot afford on a federal scale. This will cause GDP to increase and create a mirage of growth. No long-term jobs will result, no change in our trade balance will be seen, companies will not suddenly start manufacturing in America and unemployment will continue to increase or remain high. The only thing that will continue to improve is the multi-national’s profit margin and the false GDP health indicator.

“Over the last few decades, our industrial job market has atrophied while service- and public-sector jobs have grown unsustainably,” Peter Schiff, President of Euro-Pacific Capital and one of the very few who warned of the looming economic disaster in our country, well before 2007’s recession, writes. “We must restore balance. New jobs will have to come from areas that produce goods; bloated service and government sectors must be allowed to shrink. By propping up the sectors that need to contract, and running staggering budget deficits, the government cuts off the capital necessary to fund sectors that need to expand.”

What our country needs is a change in policy, not posturing by government officials who wish to appear busy. Why do you think the rest of the world is recovering while real U.S. growth remains stagnate? Our policies led to this global recession, and until we change them to motivate producers and manufacturers to come to America and hire our workers, our economy will never fully recover. The rest of the world is able to recover because they were economically sound to begin with; their only mistake was investing in U.S. treasuries and collateralized U.S. debt. They have protection in place to ensure that their trade balance remains positive and to ensure that jobs remain in their country. So, what are you waiting for, Washington?

: Trickle Down Economic Discussion (Begins at 5:02 secs)

WHY WE NEED TO LET STATES GO BROKE

By DICK MORRIS & EILEEN MCGANN Published in the New York Post on August 10, 2010

Federal Band-Aids won't cover the fiscal problems of such states as New York, California, Michigan and Connecticut forever. State bankruptcy and fundamental restructuring of state and local finance -- and labor relations -- is at hand.

Take Connecticut. In the current fiscal year, $2 billion in federal subsidies have helped tide it over the recession -- a hefty share of its $15 billion budget. But these infusions are one-shot grants, renewed only if Congress acts affirmatively to do so. Other states depend on similar manifestations of federal largess.

In Washington, the House is set to pass a $26 billion aid package this week -- fresh federal aid amounting to about 2 percent of state and local spending. But if the Republicans win control of Congress this fall, it is hard to see any legislative willingness to renew these subsidies.

Instead, GOP lawmakers will point to the examples of New Jersey, Virginia and Indiana -- where conservative governors have slashed spending to avoid tax hikes. In Virginia, Gov. Bob McDonnell has reduced spending to pre-2006 levels.

If Congress fails to renew its subsidies, the more profligate states will face cash shortfalls in the current fiscal year. They'll threaten school closures, prison releases and all manner of mayhem if their subsidies aren't renewed. But the Republicans in Washington are likely to refuse -- asking why the responsible states should bail out the spendthrifts in Albany, Sacramento, Lansing and Hartford.

At that point, the bond markets will start eyeing state (and local) balance sheets more critically -- demanding higher rates or even refusing to lend. California won't be the only one trying to get by on IOUs.

But beyond this tale of woe lies a golden opportunity to reform state governments and redress the imbalance of power between elected officials and public-employee unions.

Absent endless federal subsidies, states will simply no longer be able to afford to give the unions everything that they want. And governors -- many of them newly elected Republicans -- will realize that they can't even afford to honor agreements their big-spending predecessors OK'd.

The GOP Congress should then amend the federal bankruptcy law to provide for a way -- now absent -- for states to declare bankruptcy. (Municipalities can do so under current law, but states have no such relief.)

Here's the key: The reforms must require that states abrogate their public-employee union agreements in the bankruptcy process, just as private corporations like Delta and Chrysler have done. The wage hikes, the work rules, the pension plans all go out the window.

Few states will have the starch to cut benefits for those now receiving them. But most will cut pensions for current workers and all will slice them for future employees. Even the threat will be a powerful bargaining tool.

And beyond the fiscal adjustments, the power of the municipal- and public-employee unions will be broken.

Voters throughout America will loudly applaud if Congress tells the profligate states, "Work it out on your own. Don't look to us for a bailout."

President Obama could veto the bankruptcy reforms -- but a Republican Congress need do nothing to assist states in their plight until he relents. All of the political and financial leverage will be on Congress' side.

The result could be the greatest revolution in state and local governance since public-employee unions came on the scene. The public and the voters would get their local governments back, and the grip of public unions will be weakened. It would be the state and local equivalent of President Ronald Reagan's tough stand against the air-traffic controllers' strike.

Politically, the unions that fund and fuel the Democratic Party would be emasculated, dramatically shifting the national balance of power.

Former British Prime Minister Margaret Thatcher's prediction about socialism will have come true for America's states: "Sooner or later, they run out of other peoples' money."

Obamanomics: back AT the brink

Welcome to the recovery summer! That's what President Obama labeled it - and he even got excited as he declared that he and his administration triumphantly pulled us from the brink. Apparently we are now back at the brink because the Fed is set to downgrade the U.S. economic outlook. Glenn has more on what's in store economically. ( Transcript, Insider Audio, FREE Insider Extreme clip)

Cloward and Piven: The Strategy to End Welfare

Glenn talked about it on TV last night - the strategy many on the left think is the best way to bring about 'redistributive change' in America. The strategy was laid out in detail in a 1966 article in The Nation by two radicals, Frances Fox Piven and Richard Cloward. Find out what you are really fighting, READ THE ARTICLE HERE.

Freddie Mac Says Needs $1.8 Billion From Taxpayers

Mortgage finance giant Freddie Mac(FMCC.OB) on Monday said it

would need another $1.8 billion in aid from taxpayers, bringing its total request since it was taken over by the government two years ago to more than $64 billion. Read the Full Story — Go Here Now.

The New Push for a Global Currency

By Lew Rockwell

You surely didn't think that the governing elites would let this economic crisis pass without pushing some cockamamie scheme for control. Well, here is the cloud no bigger than a man's hand, a revival of a 60-year-old idea of a global paper currency to fix what ails us.

The IMF study that calls for this is by Reza Moghadam of the Strategy, Policy, and Review Department, "in collaboration with the Finance, Legal, Monetary and Capital Markets, Research and Statistics Departments, and consultation with the Area Departments." In other words, this paper shouldn't be ignored.

It's a long-term plan, but the plan has the unmistakable stamp of Keynes: "A global currency, bancor, issued by a global central bank would be designed as a stable store of value that is not tied exclusively to the conditions of any particular economy.... The global central bank could serve as a lender of last resort, providing needed systemic liquidity in the event of adverse shocks and more automatically than at present."

The term bancor comes from Keynes directly. He proposed this idea following World War II, but it was rejected mostly for nationalistic reasons. Instead we got a monetary system based on the dollar, which was in turn tied to gold. In other words, we got a phony gold standard that was destined to collapse as gold reserve imbalances became unsustainable, as they did by the late 1960s. What replaced it is our global paper money system of floating exchange rates.

But the elites never give in, never give up. The proposal for a global currency and global central bank is again making the rounds. What problem is being addressed? What is so desperately wrong with the world that the IMF is floating the idea of a world currency? In a word, the problem is hoarding. The IMF is really annoyed that "in recent years, international reserve accumulation has accelerated rapidly, reaching 13 percent of global GDP in 2009 -- a threefold increase over ten years."

You see, monetary policy isn't supposed to work this way. In their ideal world, the central bank releases reserves and these reserves are lent out, leading to a boom in consumption and investment and thereby global happiness forever (never mind the hyperinflation that goes along with it). But there is a problem. The current system is nationally based and so the economic conditions of one country turn out to have an influence on the borrowing and lending markets. Without borrowers and lenders, the money gets stuck in the system.

This is a short history of the last two years. By now, if the Fed had its way, we would be awash in money. Instead the reserves are stuck in the banking system. It's like the whole of the population of the United States has suddenly been consumed by the moral advice: neither a borrower nor a lender be.

And why? Well, there are two reasons. Borrowers are just a bit nervous right now about the long term. They are watching balance sheets day by day, consumed with a weird sense of reality that had gone out the window during the boom times. Meanwhile, the bankers are just a bit risk averse, happier to keep the reserves in the vault than toss them to the winds of fate. They have the bank examiners breathing down their necks right now, and lending doesn't pay well, not with interest rates being suppressed down to the zero level.

Under these conditions, yes, hoarding seems like a pretty good idea. What's more, we should be very grateful indeed for this retrenchment. The idea of plunging back into another bubble seems rather shortsighted.

The IMF has a problem with this practice, though it doesn't dwell on it. The problem is that this practice of maintaining high reserves is putting a damper on consumption and investment, prolonging the recession. The simple-minded solution coming from the high-minded eggheads at the IMF is to find some system, any system, that would push the money from the vaults into the hands of the spending public.

The rationale for the global currency and global central bank is that the reserves could always find a market in a globalized system, and would not therefore be so tied to the exigencies of a nationally based banking and monetary system.

An academic paper can wax eloquent for hundreds of pages about the advantages of a global system. It will lead to more stability, efficiency, and less politicization of money and credit. And truly, there is a point here: a real gold standard is always tending towards a global currency system. Different national currencies are merely different names for the same thing.

But there is a key difference. Under a gold standard, the physical metal is the limit and the market is the master. Under a global paper system, the paper provides no limit whatsoever and the politicians are the masters. So there is no sense of talking about the glories of globalization in the current context. A world paper currency and world central bank would heighten the moral hazard and lead to a global inflationary regime such as we've never seen. There would be no escape from political control at that point.

Every proposal of a drastic solution such as this always comes with a warning of some equally drastic consequence of failing to adopt the proposal. In this case, the IMF actually raises questions about the survivability of the dollar itself. "There has been a long-running debate speculating on whether the dollar could collapse," says the paper. It raises the worry that if a run on the dollar materializes, central banks could attempt to race each other to dump it permanently.

But, the paper points out, many people wonder whether "good alternatives to the dollar exist." And for this reason, it might be a good idea to cobble together such an alternative sooner rather than later.

There is probably more truth in that statement than most people want to grant. But the right alternative is not yet another and more global experiment in paper money inflation. God forbid. If we want an alternative to the dollar, there is one that could appear before our eyes if only we would let it happen. Private currencies traders the world over could, on their own, give rise to a new currency rooted in gold and traded by means of digital media. On many occasions over the last 20 years, such a system nearly came to be. But guess what? The government cracked down and stopped it. The governing elites have decided that there will be no currency reform unless it comes from the marble palaces of the monetary elites.

Copyright © 2010 by LewRockwell.com. Permission to reprint in whole or in part is gladly granted, provided full credit is given. Source: Campaign for Liberty

CLICK FOR VIDEO - Trickle Down Economics Continued

Obama Signs $26 Billion Bailout for Cash-Strapped States and “the Bill” Doesn’t Even Have A Name…

House OKs 2nd Stimulus, Union Bailout

President Obama signed a bill that he says will save hundreds of thousands of teacher and other public workers from unemployment.

Obama signed the measure into law just hours after the House passed it in a special one-day session during what would normally be the lawmakers' summer break.

The $26 billion bill would protect 300,000 teachers, police and others from election-year layoffs. Obama and Democrats said quick action was necessary before children return to classrooms minus teachers laid off because of budgetary crises in states that have been hard-hit by the recession.

Republicans called the bill a giveaway to teachers unions and an example of wasteful Washington spending.

The bill would be paid for mainly by closing a tax loophole used by multinational corporations and reducing food stamp benefits for the poor. It passed mainly along party lines by a vote of 247-161.

Representatives scattered around the country and world for the August break were summoned back to Washington for the one-day session as Democrats stressed the need to act before children return to classrooms missing teachers laid off because of budgetary crises in the states.

Republicans saw it differently, calling the bill a giveaway to teachers' unions and another example of profligate Washington spending that Democrats would pay for in the coming election.

The Senate narrowly passed the measure last Thursday, after the House had begun its summer break, necessitating the special session.

The legislation provides $10 billion to school districts to rehire laid-off teachers or ensure that more teachers won't be let go before the new school year begins. The Education Department estimates that that could save 160,000 jobs.

Another $16 billion would extend for six months increased Medicaid payments to the states. That would free up money for states to meet other budget priorities, including keeping more than 150,000 police officers and other public workers on the payroll.

Some three-fifths of states have already factored in the federal money in drawing up their budgets for the current fiscal year. The National Governors Association, in a letter to congressional leaders, said the states' estimated budget shortfall for the 2010-12 period is $116 billion, and the extended Medicaid payments are "the best way to help states bridge the gap between their worst fiscal year and the beginning of recovery."

Not all governors were on board. Mississippi Republican Gov. Haley Barbour said in a statement that the bill would force his state to rewrite its current year budget and it would have to spend $50 million to $100 million to get the additional $98 million in education grants.

The $26 billion package is small compared to previous efforts to right the flailing economy through federal spending. But with the election approaching, the political stakes were high.

"Teachers, nurses and cops should not be used as pawns in a cynical political game" resulting from "the Democratic majority's failure to govern responsibly," said Rep. David Dreier, R-Calif.

"Where do the bailouts end?" asked Republican leader John Boehner of Ohio. "Are we going to bail out states next year and the year after that, too? At some point we've got to say, 'Enough is enough."'

Democratic Rep. Jay Inslee said his state of Washington would get funds to keep 3,000 teachers. Republicans, he charged, "think those billions of dollars for those corporate loopholes is simply more important than almost 3,000 teachers and classrooms in the state of Washington."

Rep. Jim McDermott, D-Calif., said Republicans ignore the fact that the bill is paid for and does not add to the deficit. "They want to do everything in their power to make certain that President Obama can't get this country going again. I think in November they are going to find it was a dumb policy."

The means of paying for the bill, a result of difficult negotiations in the Senate, were also contentious.

Republicans objected to raising some $10 billion by raising taxes on some U.S.-based multinational companies. Advocates for the poor were protesting a provision to accelerate the phasing out of an increase in food stamp payments implemented in last year's economic recovery bill. Under the measure, payments would return to pre-stimulus rates in 2014, saving almost $12 billion.

James Weill, president of the Food Research and Action Center, said that would be cutting benefits for some 40 million people now receiving food stamps. "Those families will be hungrier and less able to buy healthy diets," he said.

Weill's group estimated that a family of four that may now receive about $464 a month in food stamps stood to lose about $59 if the reductions take place. Democrats gave assurances that they would look for other ways to pay for the bill before the payment cuts go into effect in four years.

"The cutbacks in food stamps in the bill are plain wrong," said House Appropriations Committee Chairman David Obey, D-Wis.

American Federation of State, County and Municipal Employees President Gerald McEntee rejected GOP arguments that the Democrats' primary purpose with the legislation was to reward their friends in organized labor. "We're in tough shape out there with these incredible holes in these state budgets. To the American people it's tremendously important and will give a little lift to the economy," he said of the legislation.

The House on Tuesday also passed a $600 million measure to boost security on the U.S. - Mexican border by hiring more enforcement officers and making greater use of unmanned surveillance drones. That bill still has to go back to the Senate.

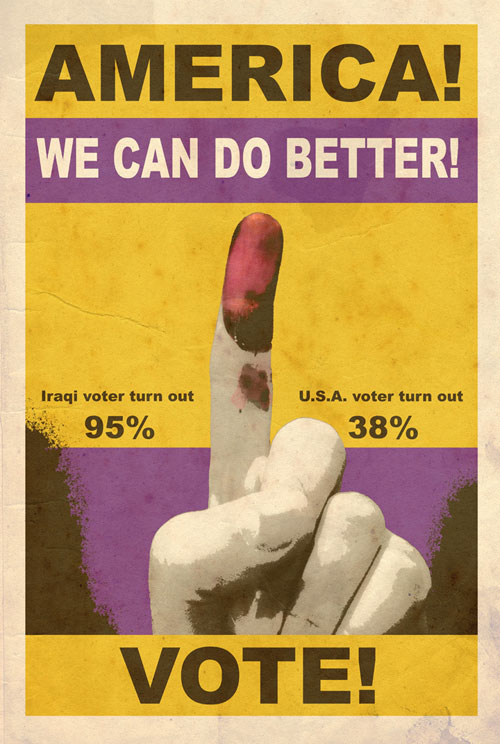

There are $421 Billion Dollars from the original stimulus sitting in a slush fund somewhere… or lost, that were supposed to be used to bailout teachers, firemen, and police; create jobs and stabilize the economy. That entire stimulus program, sold to us, was a failure. So, why would we be calling Congress back from recess for one day (and what happened to the concern about the carbon foot print?) to vote on another $26 billion dollar bill, when we could pull it for the funds that we still have and that have mysteriously never been spent or needed, after we were told if they didn’t pass this bill America would go under…?

No comments:

Post a Comment