Video: Marco Rubio: America Can’t Survive Another Obama Term

Exclusive On Hannity: Marco Rubio Lays Out What Needs to Be Done to Save America

Why I Won’t Vote to Raise the Debt Limit by Marco Rubio

Below is a write up from Liberty Action Report about Marco and his stand.

Today, ALG ( Americans for Limited Government ) President Bill Wilson praised Senator Marco Rubio for his "courageous stand" against increasing the $14.294 trillion federal debt ceiling

Senator Rubio outlined his conditions for approving any increase in the ceiling, which will be hit between April 15th and May 31st according to U.S. Treasury estimates.

"I will vote to defeat an increase in the debt limit unless it is the last one we ever authorize and is accompanied by a plan for fundamental tax reform, an overhaul of our regulatory structure, a cut to discretionary spending, a balanced-budget amendment, and reforms to save Social Security, Medicare and Medicaid," wrote Senator Rubio.

Wilson said Rubio's conditions were "reasonable." He explained, "Look, with a national debt that has already soared above $14 trillion that will become larger than the entire economy, soon the debt will become too large to even refinance, let alone ever be repaid." By 2021, the Office of Management and Budget projects the national debt will soar to over $25 trillion.

"If Senate Republicans cannot use their leverage on the debt ceiling vote to achieve significant concessions, including a Balanced Budget Amendment, to turn the Ship of State around now, will assuredly sink into the Abyss in the not-so-distant future," Wilson warned.

Currently, the $14.2 trillion national debt already stands at 95.5 percent of the nation's $14.8 trillion Gross Domestic Product (GDP). Wilson said it was unclear at what percentage of debt-to-GDP that the debt becomes too large to refinance, but that "the warning signs are already there that we cannot even meet our current obligations honestly."

"Right now, we're currently meeting our financing obligations by having the Federal Reserve simply print money to buy debt. Anyone ever heard of the Weimar Republic? How'd that work out for them?" Wilson asked.

The Weimar Republic experienced hyperinflation in 1920's as it attempted to print money to honor its war debts and reparations, destabilizing the country and leading directly to its fall.

Pimco reports that in 2009, 80 percent of treasuries were purchased by the Federal Reserve, and in 2010, it had to buy 70 percent, bringing its current U.S. debt holdings to $1.3 trillion. "The Fed is the largest lender to the U.S. government in the world, more than China or Japan. When the Fed ends QE2 in June, it will likely keep a high water mark of $1.5 trillion in treasuries holdings. That means it will still be buying U.S. debt to aid in refinancing," Wilson explained.

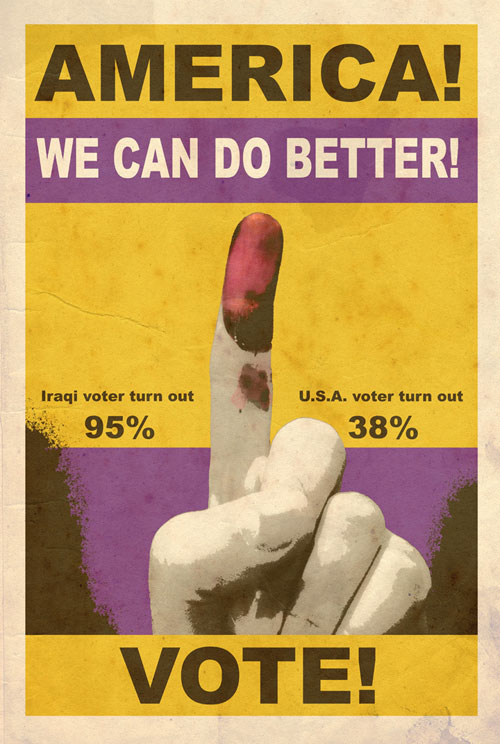

"Republicans need to do a better job of explaining the fiscal catastrophe we face, and what will happen if the debt is allowed to become too large to even refinance," Wilson noted.

"If the GOP cannot articulate what will happen to this country, specifically, if Congress fails to act and the debt soars to over $25 trillion in a decade, it will undercut their case for real fiscal reform," Wilson explained. "Either the debt will become too large to service, or it can continue to grow forever with no danger. If members truly believe that indeed it can get too large, then Senate Republicans' time to act is now."

Wilson concluded, "This is not just about getting an up-or-down vote on a Balanced Budget Amendment. This is about actually making certain that the debt ceiling never needs to be increased again. Senator Rubio's stand is an example all members should emulate. He's trying to save his country before it's too late, and we applaud him for that."

Related:

Despite Tea Party (and others) ‘Screaming in GOP Ears,’ Boehner Signals Compromise on Budget Cuts - Contact him today plus your congressperson and tell them time to take a stand!! “No compromise and No raising the debt ceiling!!

Boehner: ‘Democrats Are Rooting for a Government Shutdown’

Outrage: Freddie and Fannie Execs Pocketed $35 Million in Taxpayer Money

No comments:

Post a Comment