Can We Avoid "Taxmageddon" in 2013?

By Alan Carnuba

In 1959, during an interview with the late Mike Wallace, Ayn Rand, the author of “Atlas Shrugged”, said “A free market will not break down. All depressions are caused by government interference and the cure that is always offered is more of the same poisons that caused the disaster.”

After the stock market crashed on October 29, 1929, the government’s solution to the crisis was to raise the top tax rate from 25% to 63%. Successively this was increased to 79% and then to 94%, effectively choking off capital formation, investment, and the incentive to start new businesses.

Not until World War Two broke out in Europe in 1939 and threatened the security of the United States and its allies did Franklin D. Roosevelt reverse his failed policies that had stretched out the Depression, turning to private enterprise to build the airplanes, tanks, and guns that would be needed to defeat the Axis powers and, in 1941, the Empire of Japan. Capitalism saved America.

America suffered a little known shock to its economy on September 15, 2008, just a month and a half shy of Election Day, when around 11 AM the Federal Reserve noted a tremendous draw down of money market accounts in the nation to the tune of $550 billion dollars in just over an hour or so. The decision was made to close the accounts. Had they not done that, the Reserve estimated that by 2 PM the entire economy of the nation would have collapsed. Within 24 hours, the world economy would have followed.

The financial crisis this triggered was put off by letting the investment house of Lehman Brothers fail and by getting Congress to agree to a $700 billion program to bail out other investment firms and the insurance firm, AIG. Simply put, without a banking system, you do not have an economy.

Americans are in for another shock to the system on January 1, 2013 when nearly a half trillion in higher taxes will become the law of the land. Taxmageddon would be the largest tax hike in the history of the nation.

The taxes pose such a threat to the anemic “recovery” the economy is said to be having that a think tank called the Committee for a Responsible Federal Budget has been urging the CEOs of corporations and financial institutions to meet with members of Congress to bring pressure to resolve the gridlock that has brought the nation to the precipice of yet another financial crisis.

How bad is the prospect of January 1, 2013? A May 11th Heritage Foundation analysis listed the following:

# Income tax rates shoot up,

# the child credit rate is cut in half,

# the marriage penalty roars back to life,

# the capital gains tax rate goes up,

# the dividend tax rate soars,

# the payroll tax rate jumps two percentage points,

# the death tax is restored to its punitive past,

# the Alternative Minimum Tax relief expires, and

# a uniquely pernicious additional payroll tax hike from Obamacare takes effect unless the Supreme Court strikes down the law as unconstitutional.

These tax hikes are a combination of expiring tax cuts, particularly the Bush era cuts that President Obama decried, along with newer taxes he advocated. To put it another way, in 2011 Americans had to work 111 days to earn enough money to pay for federal, state and local taxes before they could begin to pay all their other expenses. Unless “Taxmageddon” is repealed, it will take eleven more days in 2012.

The Obama administration ignored the deficit-reduction findings and recommendations of the Simpson-Bowles commission it initiated to address the nation’s financial problems. It imposed Obamacare which will control one sixth of the nation’s economy and which is replete with all kinds of more tax provisions.

Congress put together a “super committee” to address the government’s enormous spending, the threats to the Social Security and Medicare programs, and to recommend tax reforms. It failed and, instead, imposed an across the board “sequestration” program of spending cuts so dangerous to the national security that even Obama’s Secretary of Defense called it catastrophic.

The hope now is that, after the November election, in the interim period before the next President is sworn into office and a new Congress convenes, the increases in taxes can be avoided. That is what the CEOs are belatedly pushing for.

Suffice to say, until power was returned to the Republicans in the House in 2010, a Tea Party movement success, Congress had been on a spending spree and, of course, every measure the House has been forth since then has been spurned by the Democrats, particularly in the Democrat-controlled Senate which has set a record for not producing a budget for the past three years.

Unless voters return power in the Senate to Republicans and defeat President Obama’s reelection, life in America is going to worsen and the nation faces another round of credit rating reductions that will affect its ability to borrow to meet its current debt obligations.

A great nation will have been reduced to pauper status by a profligate Congress whose only “solution” has been to raise the debt ceiling.

© Alan Caruba, 2012

PLUS, IF PASSED ADD THIS:

ON JANUARY 1, 2013, If OBAMA HAS HIS WAY, THE US GOVERNMENT WILL BE REQUIRING EVERYONE TO HAVE DIRECT DEPOSIT FOR SS CHECKS.

WONDER WHY? - HR 4646… HAVING BEEN REINTRODUCED AS HR 1125

Be sure to read entire explanation…

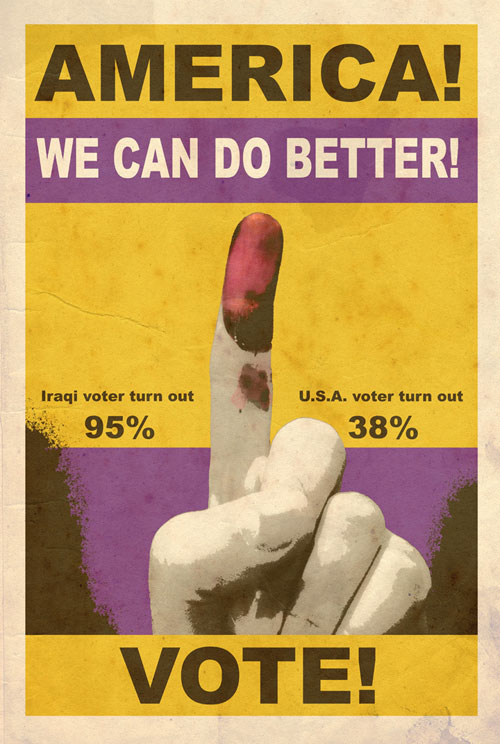

Watch for this AFTER November elections; remember this BEFORE you VOTE, in case you think Obama is looking out for your best interest.

A 1% tax on all bank transactions is what HR 4646 (HR 1125) calls for.

Do you receive a paycheck, or a retirement check from Social Security or a pension fund and have it direct deposit??

Well guess what ... It looks as if Obama wants to tax it 1% !!!

This bill was put forth by Rep. Chaka Fattah (D-PA).

YES, that is 1% tax on all bank transactions - HR 4646, every time it goes in and every time money goes out.

Ask your congressperson to vote NO.

FORWARD THIS TO EVERYONE YOU KNOW!

1% tax on all bank transactions ~ HR 4646 - ANOTHER NEW OBAMA TAX SLIPPED IN WHILE WE WERE ASLEEP. Checked this on snopes, it's true! Check it out yourself ~ HR 4646.

President Obama's finance team is recommending a one percent (1%) transaction fee (TAX). Obama's plan is to sneak it in after the November elections to keep it under the radar.

This is a 1% tax on all transactions at any financial institution - banks, credit unions, savings and loans, etc. Any deposit you make, or even a transfer within your own bank from one account to another, will have a 1% tax charged.

If your paycheck or your Social Security or whatever is direct deposit, it will get a 1% tax charged for the transaction.

If your paycheck is $1000, then you will pay Obama $10 just for the privilege of depositing your paycheck in your bank. Even if you hand carry your paycheck or any check in to your bank for a deposit, 1% tax will be charged.

You receive a $5,000 stock dividend from your broker, Obama takes $50 just to allow you to deposit that check in the bank.

If you take $1,000 cash to deposit at your bank, 1% tax will be charged.

Mind you, this is from the man who promised that, if you make under $250,000 per year, you will not see one penny of new tax.

Keep your eyes and ears open, you will be amazed at what you learn about this guy's under-the-table moves to increase the number of ways you are taxed.

Oh, and by the way, if you receive a refund from the IRS next year and you have it direct deposited or you walk in to deposit that check, you guessed it. You will pay a 1% charge of that money just for putting it in your bank.

Remember, any money, cash, check or whatever, no matter where it came from, you will pay a 1% fee if you put it in the bank.

Some will say, oh well, it's just 1%. Are you kidding me? It's a 1% tax increase across the board. Remember, once the tax is there, they can also raise it at will. And if anyone protests, they will just say, "Oh,that's not really a tax, it's a user fee"!

Think this is no big deal? Go back and look at the transactions you made from last year's banking statements. Then add the total of all those transactions and deduct 1%. Still think it's no big deal?

Can you really afford 4 more years???

The following is copied from (left leaning/Soros affiliated) Snopes… so you know it is true and coming if Obama is re-elected!:

1. Snopes.com: Debt Free America Act•••

Is the U.S.government proposing a 1% tax on debit card usage and/or banking transactions?

...It is true. The bill is HR-4646 introduced by US Rep Peter deFazio D-Oregon and US Senator Tom Harkin D-Iowa. Their plan is to sneak it in after the...

...moved beyond proposing studies and submitted the Debt Free America Act (H.R. 4646), a bill calling for the implementation of a scheme to pay down the...

...[2010] by Rep. Chaka Fattah (D-Pa.). His "Debt Free America Act" (H.R. 4646) would impose a 1 percent "transaction tax" on every financial transaction...

Wed, 02 Nov 201111:27:37 GMThttp://www.snopes.com/politics/taxes/debtfree.asp

111th Congress, 2009–2010

To establish a fee on transactions which would eliminate the national debt and replace the income tax on individuals.

- Introduced: Feb 23, 2010

- Sponsor: Rep. Chaka Fattah [D-PA2]

- Status: Died (Referred to Committee)

- See Instead: This bill was re-introduced as H.R. 1125 on Mar 16, 2011. See H.R. 1125 for current action on this subject – It is presently in committee

h/t to Jay Osborne and MJ

No comments:

Post a Comment