Heritage Foundation Report: Tax Day or Payday? How the Tax Code Is Expanding Government and Dependency

by Jane McGrath – GetStuff

Abstract: Nearly half of Americans who file federal income tax returns do not pay any federal income taxes because they receive certain tax credits. Many of these nonpayers actually receive a cash payment from the IRS because of refundable tax credits. Refundable credits are increasing the level of dependency, and nonpayers will soon reach the tipping point where a majority of tax filers pay no taxes and can vote increasing government benefits at no cost to themselves. That is a deadly recipe for never-ending increases in government spending, inevitably leading to a fiscal implosion when there are no longer enough taxpayers to pay for the expanding welfare state. Congress can begin to address this problem by refusing to create new credits or expand existing credits.

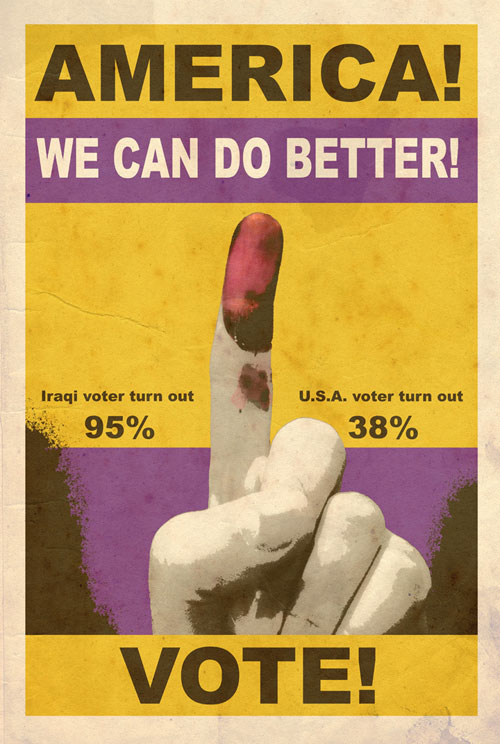

April 15, better known as Tax Day, is here once again. Tax Day used to be a painful day for most Americans because of the large amounts of money they were required to send to the Internal Revenue Service. However, for almost a majority of tax filers, Tax Day is no longer a day to dread because they pay no income tax. Many of these nonpayers[1] actually receive a sizeable amount of income redistributed to them through the tax code.

This income redistribution is making Tax Day into payday and increasing the size of government and people's dependence on the government. Tax policies pursued by Congress and President Barack Obama will only worsen the problem. Because the income tax is the main revenue raiser for the federal government, Congress should reform the tax code in a revenue-neutral way so that most Americans pay some income taxes and therefore have a stake in controlling the size of government.

The 2001 and 2003 Tax Cuts Benefited All Tax Filers

Despite the incessant protestations to the contrary, the 2001 and 2003 tax cuts were not just tax cuts for the rich. They reduced taxes for all tax filers, including all middle-income and low-income tax filers, because they lowered all tax rates, created a new 10 percent rate for income under $16,750 (married filers), and increased the standard deduction. For example, as Table 1 shows, a lower-middle-income married couple with two children making $45,000 per year will pay $2,085 less in income taxes in 2010 because of the tax cuts. That is almost 5 percent of this hypothetical family's income, which they can spend or save as they choose instead of handing it over to Washington.

The Increasing Number of Nonpayers

The tax cuts were undoubtedly a big help for low-income and middle-income families, but the reduction in tax rates also means that low-income and middle-income families are now more likely to be removed from the tax rolls entirely. This means that they have no federal income tax liability, so they are actually nonpayers. In 2000, before the Bush tax cuts, there were 33 million nonpayers. By 2008, there were 52 million nonpayers--an increase of almost 20 million with absolutely no income tax liability.[2]

The Bush tax cuts substantially lowered tax rates for all tax filers--which benefited the economy by increasing the incentives to work, save, invest, and take new economic risks--but lower tax rates were not responsible for the growth in nonpayers. Lower tax rates cannot make a tax filer a nonpayer. Tax filers are falling off the tax rolls at an increased rate because of tax credits. Both political parties like tax credits because they allow politicians to claim credit for tax cuts directed at certain favored groups of tax filers. In contrast, lowering all marginal tax rates benefits all tax filers, but this makes it more difficult for politicians to claim that they are helping certain politically advantageous groups.

Credits also allow politicians to encourage people to engage in behaviors that politicians deem beneficial. For instance, tax filers who purchase certain types of environmentally friendly cars, such as certain hybrid models, receive a tax credit for which other tax filers are not eligible.[3] Similarly, tax filers who make energy-saving improvements to their homes are eligible for another tax credit.[4] Congress has created numerous other credits that reward tax filers for doing what Washington wants them to do.

A tax credit removes tax filers off the tax rolls when the worth of the credit (or credits) exceeds the amount of income tax that a tax filer owes. As shown in Table 1, the reduction in tax rates and higher standard deduction substantially lowered the taxes on the family of four, but doubling the child tax credit from $500 to $1,000 per child almost made them nonpayers.

If the 2001 and 2003 tax cuts had not been enacted, the family would have owed $3,098 in taxes before claiming any tax credits. The 2001 and 2003 cuts reduced their taxes to $2,013 before taking any credits. This $1,085 tax reduction was due solely to the family's lower tax rate and the increased standard deduction.

However, the family can still take the child tax credit for each of their two eligible children. The $2,000 child tax credit--an increase of $1,000-- also lowered the family's final tax liability. Therefore, the higher child tax credit lowered the family's tax bill by almost as much as the lower marginal tax rates and higher standard deduction lowered it. It almost made the family nonpayers, reducing their total income tax liability to $13. As shown in Table 2, the family would have moved into the nonpayers' column if it earned slightly less income.

However, the child tax credit is not the only tax credit that is moving tax filers off the tax rolls. The earned income tax credit (EITC); the American Opportunity, Hope and Lifetime Learning education credits; the Making Work Pay[5] credit; the qualified adoption expenses credit; residential energy credits; the first-time homebuyer credit; and numerous other credits have the same effect for many tax filers. The multitude of credits increases the likelihood that tax filers who claim them will become nonpayers because tax filers can claim several of these credits at once.

At a Dangerous Tipping Point

The rapid increase in the number of nonpaying tax filers caused by tax credits is leading the country to a dangerous tipping point. According to the IRS, the bottom 50 percent of tax filers pay less than 3 percent of all taxes.[6] That share is decreasing every year, and the trend shows no signs of reversing. In fact, the new and expanded credits passed as part of the stimulus package will further reduce the share of income taxes paid by the bottom 50 percent. This could very well mean that the bottom 50 percent, perhaps even more, will pay no income taxes in 2010. Even if they still owe something for this year, the point is quickly approaching when they will pay no income tax.

Passing the point at which less than half of all tax filers pay income taxes is dangerous because beyond that threshold a majority of tax filers--and therefore approximately a majority of voters--could vote themselves an increasing share of government benefits at no cost to themselves. In fact, when the U.S. passes that point, a shrinking minority of tax filers will be financing almost all government spending. In this situation, politicians have even less incentive to restrain government spending because more votes could be won by increasing spending than lost by increasing the burden on the remaining taxpayers. That is a deadly recipe for never-ending increases in government spending that will inevitably lead to a fiscal implosion when there are no longer enough productive taxpayers to pay the bill for the expanding welfare state.

Refundable Credits Increase Dependency

Tax credits are also expanding the number of families dependent on the government. Not only does the bottom 50 percent of tax filers pay almost no taxes, but many actually receive income through the tax code because of refundable credits. A refundable credit can not only cancel all of a tax filer's tax liability, but also give the tax filer a check for the difference if the value of the credit exceeds the tax filer's income tax liability. Thus, for families that receive refundable credits, Tax Day has become payday.

For instance, after the Bush tax cuts, the hypothetical family of four has a tax liability of $13, but if they reduced their income by just $85 to $44,915, they would become nonpayers and receive a cash payment from the federal government because of the refundable child tax credit. (See Table 2.)

The child tax credit is not the only refundable credit. Other well-known refundable credits include the EITC and the Making Work Pay tax credit. In 2010, these three refundable credits will redistribute more than $114 billion to the families that claim them: $52 billion through the ETIC, $32 billion through Making Work Pay, and $30 billion through the child tax credit.[7]

Combined with a few other smaller refundable credits, these refundable tax credits cause the bottom 40 percent of tax filers to have negative effective federal income tax rates. This means that these families earning up to $64,000 per year not only pay no income taxes, but on average receive a cash payment from the IRS because of the refundable credits.[8]

Refundable credits are growing each year and are making more and more families increasingly dependent on the tax code, and therefore on the government, for a substantial portion of their income. For those that receive the cash payments, growing dependence on the tax code for their income will reduce their individual initiative to achieve because they will be able to sustain a satisfactory standard of living without exerting any additional effort. Growing dependence also reduces the incentive for top performers to work harder and earn more because they will need to pay increasingly higher tax rates to fund the growing dependency of those that earn less. If these conditions continue, the effects will stifle the economy, slow growth, and ultimately lead to a lower standard of living.

The Obama Agenda: Making the Problem Worse

The credits that are removing millions from the income tax rolls and redistributing income through the tax code have been on the books for years, but President Obama's agenda doubles down on these provisions, making an already bad problem worse.

President Obama has already pushed more tax filers off the rolls and redistributed more income to middle-income and low-income earners through refundable tax credits that were added and expanded as part of the stimulus package signed into law by President Obama soon after he took office.

The stimulus created the Making Work Pay refundable tax credit. This refundable credit is worth up to $800 for families ($400 for single filers) and is available to all tax filers earning less than $190,000 per year ($95,000 for single filers). The Making Work Pay will push millions more people off the tax rolls and redistribute billions of dollars more this year. In fact, the hypothetical family of four would now be a nonpayer and receive a nearly $800 cash payment because of the Make Work Pay credit.

The stimulus also expanded the Hope Scholarship credit (renamed the American Opportunity Education credit) and made it refundable. This will remove even more tax filers from the rolls and, because it is now refundable, send direct cash payments to many of them. The stimulus also expanded the child tax credit and the EITC, which will send more and larger cash payments to qualifying families.[9]

Increased payments through the tax code were only the first act in President Obama's plan to use the tax code to increase dependence on the government. He campaigned on a plan to raise the top two income tax rates for those earning more than $250,000 per year ($200,000 for single filers) to their levels before the 2001 and 2003 tax cuts. This would increase the highest income tax rate from 35 percent to 39.6 percent and the next highest rate from 33 percent to 36 percent. This will increase the already lopsided income tax burden paid by top earners and further reduce the portion paid by the bottom 50 percent of tax filers. The 2001 and 2003 tax cuts expire at the end of 2010, so these income tax rates will increase unless Congress acts to extend the tax cuts for all tax filers.

Slowing the Growth of Dependency

Reversing the rapid expansion of dependency that is being facilitated by the tax code will not be easy. Many tax filers have grown accustomed to not paying taxes and receiving cash payments through the tax code. Bringing them back onto the tax rolls and taking away their subsidies will be politically difficult.

Yet Congress needs to address this problem. If current trends continue, this growing dependence on the government will threaten the vitality of the U.S. economy, and government spending will grow even faster, hastening the march to fiscal bankruptcy.

At little political cost, Congress can immediately do three things to slow these long-term trends:

- Stop creating new tax credits or expanding existing tax credits, especially refundable credits. Congress should stop creating new tax credits not only because they remove tax filers from the tax rolls, but also because Congress too often uses credits to influence the behavior of tax filers and to curry favor with particular sectors of the electorate. The tax code should not be used to alter behavior or to favor certain groups with targeted tax cuts. Such practices only increase the alienation that many feel toward Congress, which seems to respond only to those with strong lobbying power in Washington.[10]

- Allow the Making Work Pay credit to expire. Under current law, the Making Work Pay credit expires in 2013. Congress should let it expire because it removes many more tax filers from the tax rolls and makes more families dependent on the tax code for income. To ensure that eliminating the credit will not become a tax hike, Congress should lower marginal tax rates commensurately.

- Extend the 2001 and 2003 tax cuts for all tax filers. Congress should also extend the 2001 and 2003 tax cuts for all tax filers and reject President Obama's plan to raise taxes on high-income tax filers. As Table 1 showed, the 2001 and 2003 tax cuts did not only help the rich. They substantially reduced taxes for low-income and middle-income tax filers. Permanently extending the tax cuts for all tax filers would keep these families' taxes low and, as an added benefit, avoid shifting even more of the tax burden to top earners.

These three measures will not stop the long-term trends that threaten to make a majority of tax filers nonpayers, but they will buy time for Congress to reform the tax code so that all tax filers except the neediest pay some income taxes. It is vital that most tax filers pay some income taxes so that they have a stake in controlling the size of government.

Fundamental Reform Needed

Fundamental tax reform is the only way to ensure that most tax filers pay some income tax because powerful constituencies protect the credits that have moved millions of people off the tax rolls. Eliminating all credits that are not justified by sound economic principles will require circumventing powerful lobbies and returning millions of nonpayers to the tax rolls. To ensure that this does not increase taxes overall, tax reform should be made revenue neutral, ideally by reducing marginal income tax rates.

Fundamental reform should also correct the numerous other flaws in the current tax system. For example, it should reduce the heavy tax burden on capital and simplify the tax code to make compliance easier. If Congress takes these necessary steps, the economy would benefit and Tax Day will cease to be payday for millions of nonpayers.

By: Curtis S. Dubay is a Senior Analyst in Tax Policy in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation.

It has become pretty obvious to all who are paying attention that our debt is unsustainable and the present tax system is just as bad. Complete Overhaul of our tax system is measure whose time has come. Options:

What's the difference between a flat tax and a fair tax?

What is the Difference Between the Flat Tax and The Fair Tax???

What is the Difference Between the Flat Tax and The Fair Tax???

iStockPhoto/Jesus Jauregui - It'd be hard to find anyone happy with our complex tax system. Some are so upset by it that they want to see a drastic reform of the whole tax code. See more tax pictures.

Most agree that America's current tax code isn't perfect. Many point to tax policy in other nations, saying they have been more effective and the United States is lagging behind. Two alternatives that claim to improve the system have come to the forefront in American politics: the flat tax and the FairTax.

You've probably heard talk of these plans in the media. In the 2000 presidential campaign, Green Partycandidate Ralph Nadar supported the flat tax, and in the 2008 campaign, Republican Mike Huckabee threw his favor behind the FairTax. But as you hear names thrown around and see bumper stickers promoting one or the other, you may have been confused about what exactly the differences are between the two.

To better understand how each plan would change things, we first have to know the basics of the current system and the major criticisms of it. As it stands, Americans pay a progressive income tax -- meaning that higher incomes get taxed at higher percentages than lower incomes. Specifically, the current system uses margins -- also known as tax brackets, or ranges of income -- to determine what percentage a person pays. Taxable income can also depend on how much you've earned in capital gains or on specificdeductions and exemptions that apply. The federal government taxes a corporation's profits in a similar way.

Ma ny critics consider the tax code confusing and impossible for the average taxpayer to decipher -- often requiring a hired professional. Even the Internal Revenue Service (IRS) Commissioner has admitted that complexity of the tax code contributes to both honest mistakes and tax evasion [source: IRS]. Others go further, saying that the progressive tax system is inherently unfair, as it puts an excessive burden on the wealthy. In relation to this criticism, opponents claim that this burden discourages behavior that would promote economic growth. Were the government to revamp the system to change this, the argument goes, all would benefit from a more prosperous economy in the long run.

Although they both have similar goals and would entail significant overhaul of the current system, the plans differ is some fundamental ways. Whereas the flat tax would tax all income at the same percentage, the FairTax wouldn't tax income at all -- it would instead institute a national sales tax. Next, we'll explain the differences in more detail.

Neither the flat tax nor the FairTax plans are radically new ideas. The U.S. implemented a flat income tax for a short time after the Civil War. Many states and countries use a flat tax today, but the specific plan for the FairTax is relatively new and dates back to the mid-1990s. Did you know that the U.S. federal government relied on sales tax before the income tax was fully enforced with the passing of the 16th Amendment in 1913? To understand how radically different the two ideas are, let's delve into how each would work.

Supporters of a flat tax believe that the only fair income tax would apply an equal percentage to all taxpayers. Specifically, many supporters advocate a rate of 17 percent. In other words, if one person earned $50,000 a year and another earned $300,000 a year, both would pay 17 percent of their income to the federal government. Although flat tax plans do away with most of the exemptions, loopholes and deductions that result in much of the complexity of the current system, many versions include an exemption for families [source: Mitchell]. Advocates say that, with a flat tax, most people could figure their annual taxes on a simple postcard.

Kenneth Lambert/Washington Times/Getty Images

Steve Forbes famously supported the flat tax in his run for president.

Although the FairTax would also drastically simplify the modern system, the idea behind how it would work is a little more complex. First, a little background on how it started: In the mid-1990s, three Houston businessmen became so fed up with the U.S. tax code that they invested in an experiment to find out the best tax system. It resulted in the group called Americans for Fair Taxation, which enlisted the advice of expert economists as well as focus groups of average people. It later gained steam with the popularity of "The FairTax Book" by radio talk-show host Neal Boortz, which explains the plan.

The most notable element of the FairTax is that it would completely abolish Federal income and corporate taxes as well as the Internal Revenue Service. Instead, it would institute a national sales tax that would pull in enough to cover all government programs -- taking revenue from what is spent rather than what is earned [source: FairTax.org]. To make sure that the poor don't suffer the brunt of these sales taxes, the government would send a monthly check called a prebate to families that would cover taxes on necessary expenses. The idea is that "no American pays tax on necessities" [source: AFT]. The check amount would be up to the poverty level; a family doesn't need to fall below the poverty line to receive one.

Don Emmert/AFP/Getty Images

Mike Huckabee speaks at a rally for supporters of the FairTax during his run for president in 2008.

The two plans have a lot in common: They both eliminate many forms of taxes and claim to be fairer than the current system. Proponents of both the flat tax and the FairTax say that their plan will improve everyone's situation because it will promote economic growth by eliminating the capital gains tax and double taxation that currently discourages productive activity like saving, investing and job creation [source: Mitchell].

Critics point to many potential transition problems with these tax plans. For the flat tax, people expecting a tax advantage won't get it. For instance, homeowners can no longer expect a tax deduction for the interest on their mortgage [source:Weisman]. For the FairTax, some argue that immediately before we switch over, consumers will buy items on credit without the tax and then pay for the credit for years to come with untaxed income.

In response to these accusations, the Tax Foundation group -- which aligns itself with neither plan -- argues that any problems with transition to the new system are worth the benefits each would produce [source: Hodge].

Neither plan has yet gained enough support in Congress to overhaul the existing system. Time will tell if Americans will see one of these, or perhaps some other plan, take over the unpopular tax code.

TAXES: Remember Obama’s Promise: No Tax Increases for Anyone Making Less Than $250K?

2010: The Year of Taxes Beyond Belief

Congressman John Campbell - Taxes Enacted Since January 2009

Art Laffer, Glenn Beck, Jerry Brown and Steve Forbes are in favor of the Flat Tax vs. Mike Huckabee, Mike Pense, Darrell Issa and Michael Reagan support the Fair Tax… Either would be a huge improvement

A little bit of good news: Value Added Tax got a Thumbs Down the Senate Today: ABC’s Z. Byron Wolf reports: FWIW – On Tax Day, and as part of an unemployment benefits extension, Senators also just approved a non-binding, Sense of the Senate amendment written by Sen. John McCain that suggests there should be no European-style Value Added Tax.

Video: Fair Tax vs Flat Tax

![tax_day_2010_thumb[1] tax_day_2010_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEioDCa_ie8Lk4Q80Ulh5-YH-hUPjCjW74c00N-0mJbYnpR-jZeP6A_7tZNUZmZwuqqKmPHEGXOBY5U89f_Wu9fGJjwJLjUSAy2JOuIYBbdUFR9mhVg1Eo262V0Qo7EYP5lLEWk5_4a-4Hs7/?imgmax=800)

No comments:

Post a Comment